Discover Reliable Tax Providers for Your Estate Planning Needs

Browsing the intricacies of estate preparation requires an extensive understanding of the tax obligation implications that can significantly affect your wealth conservation strategy. Involving trustworthy tax solutions is vital, however determining the right professionals can be challenging provided the myriad of options offered. Secret factors to consider include their know-how in current tax guidelines and their ability to connect efficiently with customers. As you consider the finest strategy to safeguard your estate, exploring the important top qualities and assessment methods for prospective tax obligation provider will be vital. What requirements should you prioritize to guarantee you make an educated choice?

Recognizing Estate Tax Obligation Effects

Recognizing the inheritance tax implications is important for effective estate preparation. Estate tax obligations can considerably decrease the riches passed on to beneficiaries, making it essential for people to grasp exactly how these tax obligations relate to their estates. The federal estate tax puts on the value of an individual's possessions at the time of fatality, and it is levied on estates exceeding a particular limit, which can differ annually. It is essential to be knowledgeable about both federal and state estate tax obligation guidelines, as some states impose their very own inheritance tax with varying exception limits.

Reliable estate preparation entails methods to reduce tax liabilities, such as making use of trust funds, gifting properties during one's lifetime, and taking advantage of reductions and exceptions. People ought to additionally take into consideration the timing of asset transfers and the implications of numerous ownership structures. Participating in complete financial assessments and forecasting possible tax obligation responsibilities can assist in creating a durable estate plan that straightens with one's monetary objectives. Eventually, understanding inheritance tax implications not only help in riches preservation yet likewise makes certain that recipients get the desired inheritance with minimal tax burdens.

Trick Qualities of Dependable Tax Providers

Dependable tax services play a vital role in efficient estate planning, guaranteeing that people navigate the intricacies of tax obligation guidelines with confidence. When seeking reliable tax obligation services, numerous vital high qualities ought to be taken into consideration.

First, experience in tax law is crucial. Specialists should possess a deep understanding of both government and state tax obligation policies, particularly as they refer to estate planning - Estate Planning. This know-how enables them to supply tailored approaches that decrease tax liabilities and enhance recipients' advantages

Second, solid communication abilities are essential. Trusted tax service companies should convey complicated tax obligation concepts plainly and briefly, enabling clients to make informed choices. They should also be responsive to client queries, guaranteeing that all concerns are addressed promptly.

In addition, a proven performance history is important. Seek providers with favorable customer endorsements and successful medical history, which demonstrate their capability to deliver reliable results.

(Frost PLLC)Last but not least, ethical requirements and integrity are non-negotiable. Dependability in taking care of delicate economic details is essential, as customers need to feel safe in their relationship with their tax obligation service supplier. By focusing on these qualities, people can efficiently guard their estate planning ventures.

How to Assess Tax Obligation Provider

When seeking to examine tax obligation provider for estate preparation, it is vital to take into consideration a systematic method that consists of assessing credentials, experience, and customer satisfaction. Begin by confirming the provider's certifications, guaranteeing they have appropriate qualifications such as Certified Public Accountant (CPA) or Enrolled Representative (EA) These qualifications show a level of know-how and adherence to sector criteria.

Following, examine the company's experience, specifically in estate preparation and tax obligation law. A firm with a tested performance history in managing situations comparable to your own will likely supply even more customized and reliable advice. Ask about their familiarity with state and federal tax policies in addition to any type of recent adjustments that might impact your estate.

In addition, customer satisfaction works as a crucial statistics in analysis. Choose evaluations and reviews from past customers to determine their experiences. A reliable company ought to agree to share references or provide study showing effective end results.

Finally, consider the provider's interaction style and availability. An excellent tax service copyright must be approachable, receptive, and able to discuss complex tax obligation problems in a clear and understandable way, ensuring a joint relationship throughout the estate preparation process.

Questions to Ask Prospective Advisors

To ensure a comprehensive analysis of possible tax consultants for estate preparation, it is essential to prepare a set of targeted concerns that reveal their experience and technique. Begin by inquiring regarding their qualifications and experience particularly in estate preparation and tax solutions. Ask about their academic history, certifications, and the variety of years they have actually worked in this field.

Following, review their familiarity with the present tax obligation laws and guidelines. Inquire about exactly how they remain upgraded on changes in tax regulation and their method to continuing education. Comprehending their approach is important; ask to describe their procedure for creating tax techniques customized to your estate intending demands.

(Frost PLLC)

Additionally, clarify their cost structure. Are they charging a level rate, per hour fee, or a portion of the estate? Understanding expenses ahead of time can prevent misconceptions later on.

Lastly, demand referrals or reviews from previous clients. This can provide insights right into their reliability and client contentment. By asking these questions, you can assess a possible advisor's ability to properly support your estate planning and tax demands.

Resources for Searching For Tax Obligation Experts

Finding qualified tax obligation specialists for estate preparation calls for accessibility to a selection of sources that can simplify the search procedure. One reliable method is specialist organizations, such as the National Organization of Tax Professionals (NATP) or the American Institute of Licensed Public Accountants (AICPA) These organizations maintain directories of qualified specialists that concentrate on tax obligation solutions appropriate to estate planning.

Referrals from lawyers or monetary consultants can produce trustworthy referrals, ensuring that you attach with specialists who have a proven track document in estate preparation. Additionally, regional community sources, such as chambers of commerce or estate planning workshops, can assist identify trusted tax specialists within your area.

Using these sources successfully can help with a thorough my explanation vetting procedure, ultimately bring about the choice of a qualified tax obligation expert that aligns with your certain estate planning requirements.

Verdict

Determining dependable tax obligation services for estate preparation is important for effective wide range preservation. By concentrating on experts that demonstrate knowledge in both government and state tax laws, integrated with solid communication abilities and positive client testimonies, individuals can boost their estate planning outcomes. Making use of available sources, including professional organizations and on-line platforms, furnishes individuals with the necessary tools to locate competent specialists tailored to particular demands, ultimately making certain optimal results in taking care of inheritance tax ramifications.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Anthony Michael Hall Then & Now!

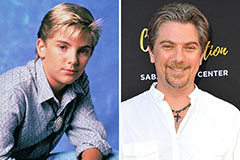

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! David Faustino Then & Now!

David Faustino Then & Now!